One of my favourite spreads

21 June 2021

A bearish winter for the Australian dollar

5 July 2021It is July and during the summer I do not like trading, both because volumes drop a lot and I am more exposed to speculation, and because I would like to take a few weeks off to rest and recover from the stresses of a whole year's work.

However, referring back to my last article on non-ferrous metals (https://tradingwithdavid.com/en/metals-china-and-russia-seek-to-curb-prices/) there is a calendar spread on copper that I find particularly interesting. It is a spread featured in my book on the best seasonal spreads of 2021, and precisely HGU21-HGZ21. The spread has a bearish seasonality from June/July until August/September (anyone who has read the book knows how I consider entry and exit of a seasonality).

I am bearish on copper for several reasons. One, as you read a couple of days ago, China wanting to curb the rise in non-ferrous metal prices by releasing part of its reserves on the market. This should throw some water on the bullish fire (however, I do not expect it to make a move like the lumber of the last month and a half). Then, there are other aspects of the spread that I am now going to analyse.

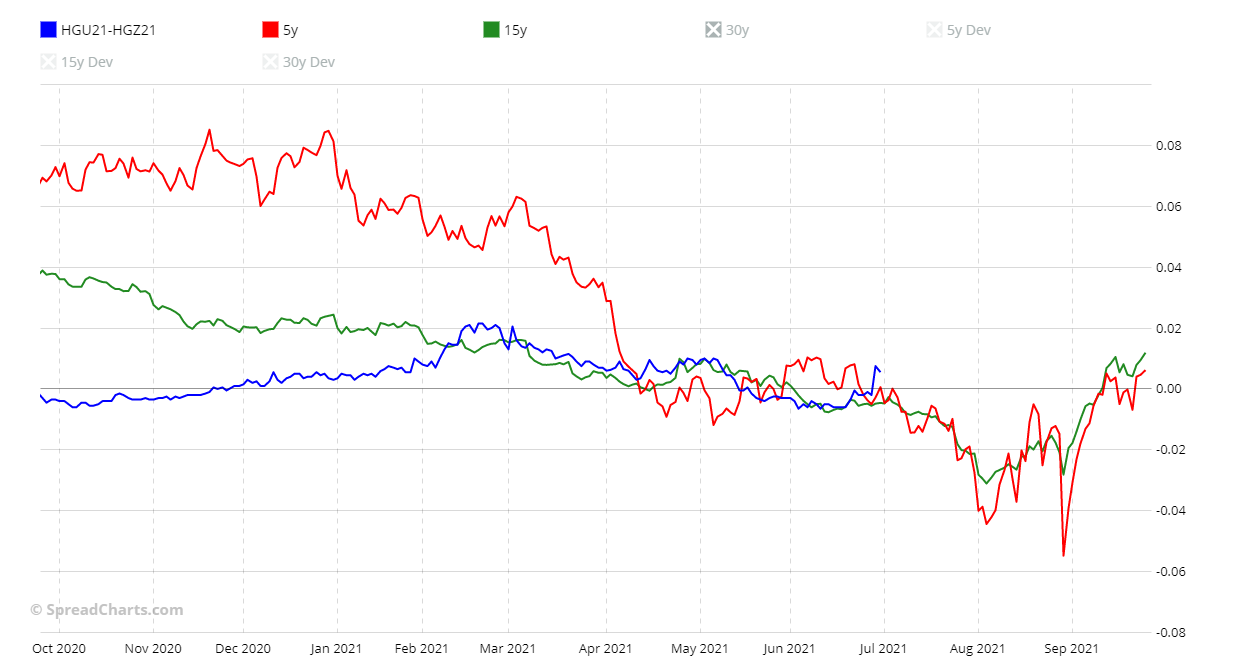

First, I show you the chart with the 5- and 15-year seasonal patterns.

As you can see, and it could not be otherwise as the spread at this time of year has a bearish seasonality, the two seasonal patterns are bearish. However, since February/March last year, many seasonality have not lived up to expectations due to the pandemic.

Looking at the last few years, you can see from the continuous price chart below that the current price of the spread, although below the May highs, is always at a high level and, most of all, in backwardation.

This is also confirmed by the Seasonality stacked chart with the current spread (in blue) above all others.

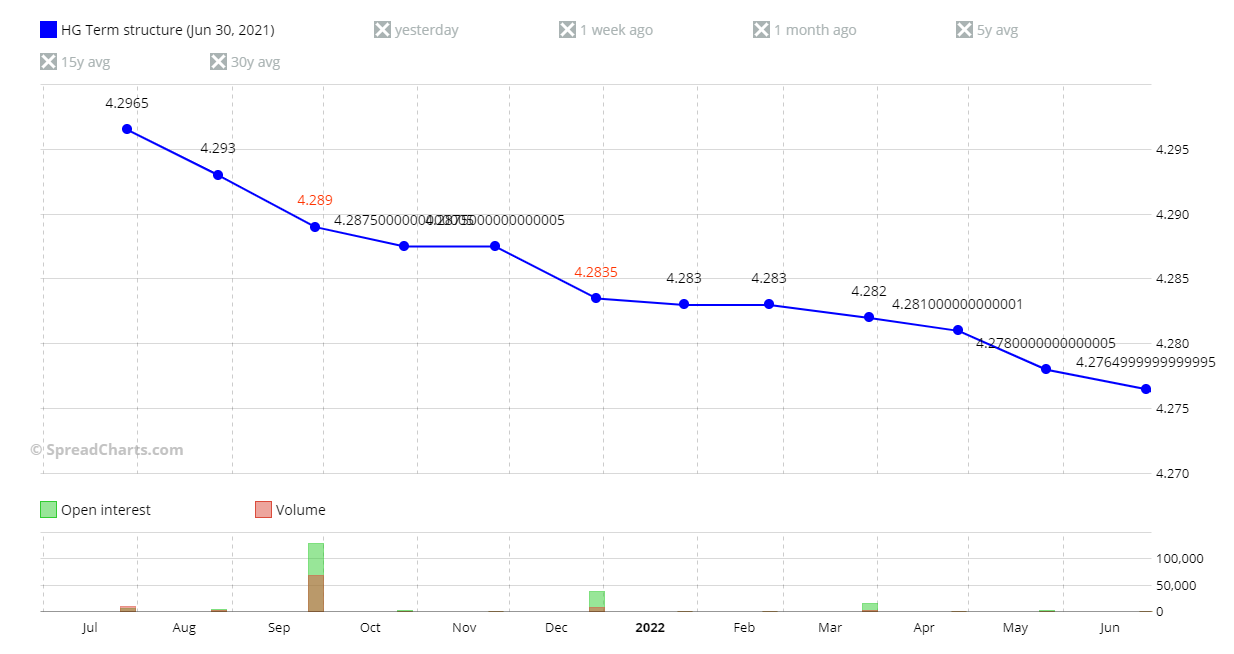

The term structure (chart below) is in backwardation and could not be otherwise after the strong rise of the past few months. Although not included in the article (given the large price difference it would have read badly), the 5 and 15 averages are in contango and even compared to a month and a week ago, the backwardation is now more pronounced. By selling the spread I am on the side of a return of the term structure in contango.

Moreover, if you take a look under the term structure, you will not escape the fact that the two deliveries, September (above all) and December, are those with the greatest volumes and open interest. This is an important aspect that does not make me worry in case of an early exit from the trade. I am now going to evaluate the backwardation with the next chart, the continuous histogram and that you see below.

From the chart you can see that over the last 20 years the spread spent 34.37% of the time in backwardation (although not shown, over the last 5 years the percentage drops to 10.25%). It is true that the current spread (0.005) is within the 25th-75th percentile range, but it is also clear that the sharply higher columns which act as spread attractors are at -0.004/-0.010 (which is also the target area for my trade).

To conclude, I will move on to see how the Large Traders (the Non-Commercial) are positioned by looking at the COT net position chart (below).

What seems pretty clear to me from the chart above is how Speculators (i.e. Non-Commercial) have not been too confident in copper's sharp rise. With the price much higher than the August 2018 highs, the Speculators' net position came in at a high of 91k compared to 125k three years earlier.

Furthermore, the bearish divergence shows how, long ago, the Speculators had started to take profits and close out positions. Then, as the price fell, the selling increased and the Speculators rushed to close their positions with a net position falling last Friday to 19.3k despite the price still being much higher than that touched in August 2018.

In conclusion for a variety of reasons seen above the spread is bearish. The target area is as mentioned at -0.004/-0.010 while for entry (first two sensitive levels 0.007 and 0.009) and stop-loss I leave the decision to you.

Even though I do not like trading in summer, there is a calendar spread on copper that I find particularly interesting, precisely HGU21-HGZ21. The spread has a bearish seasonality from June/July until

I am a macroeconomic and financial analyst with over 30 years’ experience, including two years as a fund manager. I specialise in currencies and commodities, and I am the author of several successful books on trading, macroeconomics, and financial markets.