A fundamental aspect of trading

20 January 2022

The best spreads to trade are…

21 January 2022Today I am analysing one of the many spreads in my book on the best seasonal spreads, a spread on soybean oil, more precisely ZLQ22-ZLZ22 (alternatively you can use ZLU22-ZLZ22 or ZLV22-ZLZ22). Let me start by showing the chart with the 5-, 15- and 30-year seasonal patterns.

The spread is in positive (above zero) and therefore in backwardation. Usually, I do not look at the 30-year seasonal pattern, however this time I wanted to show how for at least 30 years during the seasonal window the three seasonal patterns are well correlated and very close together. Bearish seasonal window highlighted in yellow in the chart and running from February to April.

Below you can see the chart Seasonality by month.

The chart shows that February has been a bearish month for the spread in 4 of the last 5 years, and in 10 of the last 15, while March has been a bearish month in 4 of the last 5 years, and in 13 of the last 15. This confirms the bearish seasonality which then ends in April, the month which, most years, has seen an increase in the spread.

I am now going to assess the price of the spread and do it by looking at two charts. The first is the Seasonality Stacked which you can see below.

The spread is at a medium-high level compared to the last 10 years, although in the only time the spread has been priced higher, it has moved against seasonality. Even though it was last year's spread that, for one reason or another (covid, inflation, heavy speculation), most of the time saw seasonality not being respected.

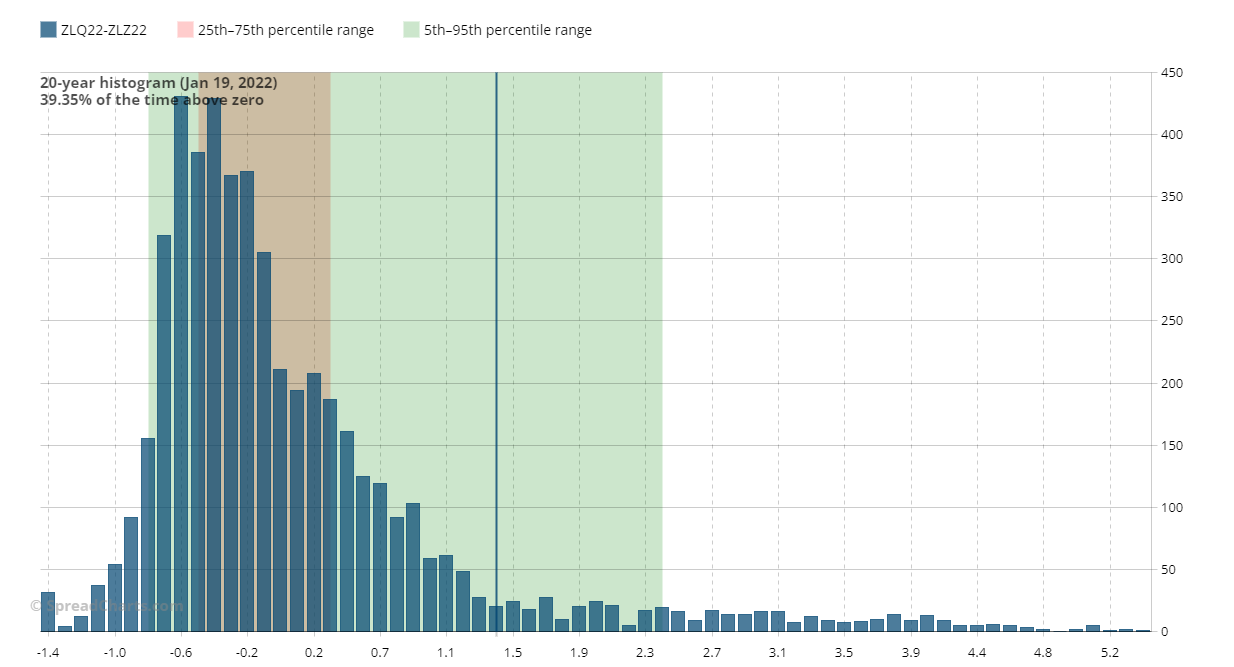

The second chart is the Continuous histogram.

Certainly ZLQ22-ZLZ22 has seen much higher prices than the current one, however it is clear that most of the time the spread has spent it in negative territory, i.e., in contango. The highest columns are concentrated between -0.2 and -0.7. This does not mean that the spread can be sold at the current price.

The last chart I show is the COT chart, which you can see together with the continuous price.

The net position remains close to 60K (55.9K) which has been exceeded several times in recent years. If it happens again, this could push soybean oil back to the highs, by mid-year.

The other charts add nothing to the analysis. I am going to see what the latest WASDE tells me about soybean oil.

Practically no change compared to the previous month. There has been an increase in production, but this has been balanced by an increase in exports, leaving the ending stocks unchanged. The average price is also unchanged at $65. The difference with the previous year remains clear.

I draw the conclusions. Under normal conditions, the spread would be very interesting, but in this period, there are many variables that influence and move the markets. The spread is certainly not for selling now. I would at least wait for a likely return to the $1.80/2.00 area.

However, the high inflation underestimated by Powell, who is now rushing to remedy it with a more hawkish monetary policy, continues to support prices and will continue to do so throughout this year (at least). Selling a calendar spread and thus being potentially bearish on the underlying may not be the right choice this year, at least in most cases. And that is the point of this analysis of mine.

Indeed, I would not be surprised if, like last year, ZLQ22-ZLZ22 had a bullish trend in the coming months. So, personally, I am reluctantly giving up on this spread which, until 2020, was one of those quiet spreads that ensured a profit every year. This is not to say that it cannot follow the bearish seasonality and fall in February-March, but that the probability of it doing so has dropped considerably and in trading, ultimately, it is all about probability.

Today I am analysing one of the many spreads in my book on the best seasonal spreads, a spread on soybean oil, more precisely ZLQ22-ZLZ22. Let me start by showing the chart with the

I am a macroeconomic and financial analyst with over 30 years’ experience, including two years as a fund manager. I specialise in currencies and commodities, and I am the author of several successful books on trading, macroeconomics, and financial markets.

1 Comment

Love the honest follow up. Reading your spread books now.I have a lot to learn but am enjoying the journey.

Regards,

Keth