A little bit of practice

4 January 2023

First steps

4 January 2023Have you ever had the feeling that, despite all the strategies you have learned and all the things you know about trading, you still have no idea how to manage a trade once you have entered a market? And if so, does this make you feel a real sense of frustration?

At the beginning of my activities as a trader, I felt stressed and anxious whenever a price approached my stop-loss. This often led me to reconsider my positions, which then led me into making the worst mistake a trader can make: raising the stop-loss.

In my career as a trader, I made a real qualitative leap when I began focusing on the devastating effects my emotions had on my results. At first, though I was convinced I had a good strategy, I could not say with certainty that I was making a profit, and with even less confidence, that I was being constant over time. In practice, I made two big mistakes.

Beyond all the recommendations I read on the internet and books (which I never translated into a method for me to follow), the first mistake was: I did not really understand what the way to deal with my emotions was. The second mistake was the absence of a real, simple, clear, and most of all workable system for following my own trading plan.

Once I identified these two mistakes, I began running downhill. What did I do? To control my emotions, and to have an exponential increase in results, I had to figure out exactly how to manage risks, so as to not simply continue repeating that it was something I needed to learn to do. I am now going to teach you a method to achieve this result, in order to transform you into a profitable trader over time.

The first step, to contain risks, is to limit alternatives. You need to have an easy-to-understand plan, one that consists of simple “yes” or “no” schemes. This will lead you to develop a trading pan that is easy to follow and that leaves no room for doubt, which is then based on emotional problems.

With a trading plan conceived in this way, you will have all the emotional and technical aspects of trading under your control, transforming you into the executor of your trading plan.

This is the best way to become conscious and constant over time, turning you into a relaxed trader. You have to eliminate all your doubts from your trading plan; you must start from a recognisable and measurable element. Now, I will show you how to build a scheme, a trading plan, that leaves no room for doubt or emotional problems.

Know thyself. Trading plans are never the same for everyone, as they change from person to person according to each individual. Your risk appetite, for instance, will be different to mine. So, the first aspect you have to decide is the percentage of money, based on assets, to allocate to each trade. A percentage of money that will not cause any trouble to you and your trading account in case you lose it.

Another thing you can define is the maximum number of trades open at the same time on each asset. For example, you can decide that at most, you will have three open trades on Forex and two on spread trading with commodities. In this way, you create some limits that will allow you to manage all your operations better. This enables you to minimise the risk of getting in trouble or overtrading.

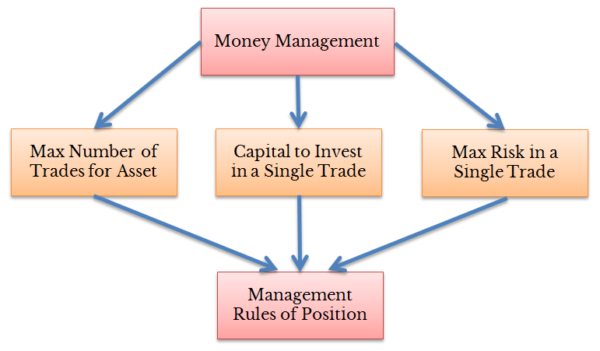

Finally, you need to establish the maximum bearable loss for each trade. You can see schematically these three “steps” in the flowchart below.

Set out your goals. Once you have determined the maximum loss for each operation, you have to do the same process with the profit you want to get.

By doing this, you will eliminate most of the emotions surrounding a trade. This is because, before even opening a trade, you will know the part of your capital you are risking, how much, in the worst-case scenario, you risk losing, and similarly, how much you may gain as well.

The next step is position management, as you can see schematically in the flowchart below.

At this point, you will have decided already where you wish to place your stop-loss and target profit. If they give you a Risk/Reward (R/R) of at least 1:1 (or the ratio you decided), then you can transmit the order on the platform; otherwise, you stay flat. In the next chapter, I will show you how to calculate the right position to open, based on your maximum loss and stop-loss.

Your operation will end (If it ends prematurely, do not change the conditions that led you to open the trade in the first place) with the achievement of one of the two levels: target profit or stop-loss. If the operation concludes positively, you will record it in your journal (I will go into more detail about this in the third section). In the case that your trade reaches the stop-loss, you have to analyse whether you have followed the plan correctly and, if not, understand the mistakes you have made.

What you have seen so far is just a part of a trading plan. The other part is about the strategy you should employ. This too should have a few rules that are simple and clear to follow. These should always follow the same scheme: either yes, which leads you to go ahead, or no, which stops you from opening a trade.

Here is a very simple example of a strategy. You follow a trend, using the Engulfing pattern after a retracement. You can see this simple strategy synthesised in the flowchart below.

Of course, every single step of the strategy has to be clear; it must not cause any doubt. So, ultimately, you have to care about every aspect, even the smallest details of your strategy and trading plan.

In this way, you will create a simple trading plan that will not cause the slightest doubt about what you need to do. A very clear scheme: either yes or no. Therefore, it is up to you to put yourself in the ideal conditions for trading, by creating your own trading plan that is tailored to you and based on your personal risk appetite and strategies.

A plan that will not cause you stress or doubt every time you open a new trade. Calmness and tranquillity are fundamental, not only to creating a lasting and successful business but also to ensuring a good quality of life.

You will of course have to follow this plan with no exceptions, and thus with strict discipline. This is the only way to trade professionally, to have a profitable business, and most of all, to become constant over time. It is the only way to reduce the number of individuals who waste their savings by doing what they think is a “game.”

Having a trading plan will make your trading much more comfortable. Think of it as your GPS (or compass) in the trading world. Enter your destination and follow the various steps necessary to reach it, testing various routes to find the best one.

Now, let me clarify something. The plan you saw above is just an example to make you understand how it should be developed. You have To create your own trading plan, based on your personal trading preferences and the conditions dictated by your strategy. You have to plan every aspect. In this way, no matter what happens, you will always know how to behave.

More generally, a trading plan should consist of a set of rules that define how and when you should place your trades.

- Market(s) on which you will trade (which instruments you will use, such as futures, currencies, commodities, options, etc.).

- Liquidity (your ability to execute an order quickly and effectively without causing a significant price change).

- Amplitude, how tight is the bid/ask spread margin?

- Depth, how deep is the market (how many orders are behind the best offer)?

- Immediacy, how fast can a large order be placed in the market?

- Recovery capacity, how long does it take for the market to recover after placing a large order?

- Execution at the desired price or with price variation compared to the order (slippage)?

- Volatility (quantity and speed at which prices vary in a particular market).

- Position Sizing rules (the dollar value of your trade can also be used to define the number of shares or contracts you will trade)

- Entry Rules (conservative or aggressive).

- Trade filters (candles/bars, time, price, movement, stop order).

- Exit Rules (profit targets, stop-loss, trailing stop, stop & reverse strategies).

So, what is the recipe for becoming a successful professional trader? A professional trader works hard, plans, tests and re-tests until he or she gets the desired results. You too can achieve success in trading by starting with a solid plan to follow in every situation.

I am a macroeconomic and financial analyst with over 30 years’ experience, including two years as a fund manager. I specialise in currencies and commodities, and I am the author of several successful books on trading, macroeconomics, and financial markets.