Bank of Canada meeting on 26 January 2022

26 January 2022

FOMC Meeting and Eur-Usd

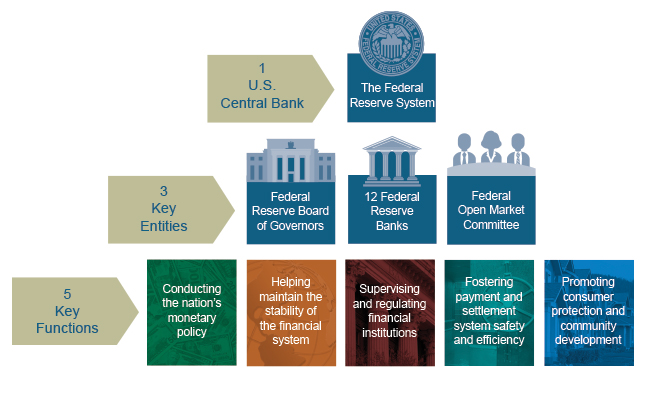

27 January 2022The Federal Reserve System was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of financial panics (particularly the one of 1907) led to the desire for central control of the monetary system in order to alleviate financial crises.

It is composed of several layers. It is governed by the presidentially appointed Federal Reserve Board of Governors. Twelve regional Federal Reserve Banks, located in cities throughout the nation, regulate and oversee privately owned commercial banks. The Federal Open Market Committee (FOMC), which sets monetary policy.

The Federal Reserve System performs five general functions to promote the effective operation of the U.S. economy and, more generally, the public interest. The Federal Reserve

- conducts the nation's monetary policy to promote maximum employment, stable prices, and moderate long-term interest rates in the U.S. economy;

- promotes the stability of the financial system and seeks to minimize and contain systemic risks through active monitoring and engagement in the U.S. and abroad;

- promotes the safety and soundness of individual financial institutions and monitors their impact on the financial system as a whole;

- fosters payment and settlement system safety and efficiency through services to the banking industry and the U.S. government that facilitate U.S.-dollar transactions and payments; and

- promotes consumer protection and community development through consumer-focused supervision and examination, research and analysis of emerging consumer issues and trends, community economic development activities, and the administration of consumer laws and regulations.

In establishing the Federal Reserve System, the United States was divided geographically into 12 Districts, each with a separately incorporated Reserve Bank. District boundaries were based on prevailing trade regions that existed in 1913 and related economic considerations, so they do not necessarily coincide with state lines. The Districts operate independently but under the supervision of the Federal Reserve Board of Governors.

The FOMC is the body of the Federal Reserve System that sets national monetary policy. The FOMC makes all decisions regarding the conduct of open market operations, which affect the federal funds rate (the rate at which depository institutions lend to each other), the size and composition of the Federal Reserve’s asset holdings, and communications with the public about the likely future course of monetary policy. Congress enacted legislation that created the FOMC as part of the Federal Reserve System in 1933 and 1935.

The FOMC consists of 12 voting members--the seven members of the Board of Governors; the president of the Federal Reserve Bank of New York; and 4 of the remaining 11 Reserve Bank presidents, who serve one-year terms on a rotating basis.

All 12 of the Reserve Bank presidents attend FOMC meetings and participate in FOMC discussions, but only the presidents who are Committee members at the time may vote on policy decisions.

By law, the FOMC determines its own internal organization and, by tradition, the FOMC elects the Chair of the Board of Governors as its chair and the president of the Federal Reserve Bank of New York as its vice-chair. FOMC meetings typically are held eight times each year in Washington, D.C., and at other times as needed.

The FOMC is charged with overseeing “open market operations,” the principal tool by which the Federal Reserve executes U.S. monetary policy. These operations affect the federal funds rate, which in turn influence overall monetary and credit conditions, aggregate demand, and the entire economy. The FOMC also directs operations undertaken by the Federal Reserve in foreign exchange markets and, in recent years, has authorized currency swap programs with foreign central banks.

If you are interested in reading the Statements and Minutes of the main central banks you can find them in the Central Banks meetings category, while the weekly reports are in the Weekly Reports category. In addition, you can find the calendar of the major central banks' meetings for this year on the page Central Banks meetings calendar 2022.

Next FOMC meeting: 16 March 2022

The Federal Reserve System was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of financial panics (particularly the one of 1907) led to the desire for central control